Image source: The Motley Fool.

Xinyuan Real Estate Co., Ltd. (NYSE:XIN)Q4 2018 Earnings Conference CallFeb. 15, 2019, 8:00 a.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Good day, everyone, and welcome to the Xinyuan Real Estate Company Fourth Quarter 2018 Earnings Conference Call. Please note that today's call is being recorded.

I would now like to turn the conference over to Mr. Bill Zima, ICR. Please go ahead.

William Zima -- Investor Relations

Thank you, operator. Hello, everyone, and welcome to Xinyuan's Fourth Quarter 2018 Earnings Conference Call. The Company's fourth quarter earnings results were released earlier today and are available on the Company's IR website as well as on newswire services.

Before we continue, please note that the discussion today will contain forward-looking statements made under the Safe Harbor provisions of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements involve inherent risks and uncertainties. As such, our results can be materially different from the views expressed today.

Further information regarding these and other risks and uncertainties is included in our registration statement and our Form 20-F and other documents filed with the US Securities and Exchange Commission. Xinyuan does not assume any obligations to update any forward-looking statements, except as required under applicable law.

Today you will hear from Mr. Lizhou Zhang, the Company's Chief Executive Officer, who will comment on our operating results; he will be followed by Mr. Xuefeng Li, the Company's Interim Chief Financial Officer, who will provide some additional color on Xinyuan's performance, review the Company's financial results, and discuss the financial outlook. Following management's prepared remarks, we will open up the call to questions.

With that said, I would now like to turn the call over to Xinyuan's CEO, Mr. Zhang. Please go ahead.

Lizhou Zhang -- Chief Executive Officer & Executive Director

Thank you, Bill. Good morning. And thank you all for joining our fourth quarter 2018 earnings conference call. We are pleased that Xinyuan has maintained strong growth despite the downward pressure on sales across the industry. For the 2018 full year results, the total amount of contracts signed in the year 2018 was $3.2 billion, which is 42.4% higher than in 2017. Correspondingly our full year total revenue increased by double digits.

Due to the successful selection and execution of our projects, gross profit margin for the year increased to 27.5% resulting in bottom line growth of more than 20% (ph), well above our forecast of 20% to 20% (ph). In the fourth quarter of 2018, our revenue increased substantial reaching 49.1% growth over the fourth quarter of 2017.

We also made notable improvements to our margins. Gross profits increased 72% year-over-year and the gross margin reached 28.7%. Demand for our active projects in China remains steady and positive, and we advanced on multiple projects while driving positive results for our shareholders.

During the fourth quarter, we commenced pre-sales of 10 new projects, five in Zhengzhou, two in Suzhou, and others in Qingdao, Jinan, and Dalian (ph). Domestic projects made significant contributions to our total GFA sales and total contract sales.

In term of offshore development. In the first quarter of 2018, our projects in the US and the Malaysia continued to proceed as planned and our UK project made even further progress in both construction and sales. During the past year, we maintained our commitment to controlling our financial leverage. We successfully reduced our short-term debt ratio (ph) by repurchasing the outstanding bonds and optimizing the debt structure. With increased profit and controlling leverage, we expect to further enhance our financial health.

In addition, we are also pleased to continue our dividend payments in this quarter and our ability to deliver value to our shareholders. Going forward, we remain optimistic about our ability to achieve positive operating performance by focusing on our core business, maintaining our competitive advantages, and strengthening our market-leading position.

Now please allow me to turn the call over to our Interim CFO, Mr. Li Xuefeng. Xuefeng, please go ahead.

Xuefeng Li -- Interim Chief Financial Officer

Thank you, Mr. Zhang. Hello, everyone, and welcome to Xinyuan's fourth quarter 2018 earnings conference call. Allow me to take you through the financial results for this quarter, further discuss our latest operations and the initiatives, and conclude by updating you on our financial outlook for the remainder of the year.

To comply with the SEC's and the Financial Accounting Standards Board's requirements, we have adopted ASC 606: Revenue from Contracts with Customers on January 1st, 2018. We adopted ASC 606 on an over-time basis via the cost input method and applied the standard only to contracts not completed as of the date of adoption. That means part of our profits will be recognized later than previously estimated under the percentage of completion method.

Our first quarter results reflect the adoption of ASC 606, especially with regards to revenues and net income and may not be directly comparable to the same period last year. All references below are in US dollar terms, unless otherwise specified (ph). Contract sales was $724 million in the fourth quarter of 2018 compared to $823.3 million in the fourth quarter of 2017 and $571.3 million in the third quarter of 2018.

Total GFA sales in China were about 355,600 square meters in the fourth quarter compared to 443,600 square meters in the same quarter last year and 277,500 square meter in the last quarter. Total revenue increased 49.1% to $1,081.8 million from $725.7 million in the fourth quarter of 2017, and increased 81.7% from $595.5 million in the third quarter of 2018. Increase was mainly due to centralized delivery of projects and pre-sale of 10 projects in fourth quarter.

The average selling price per square meter sold in China was around RMB13,500 in the fourth quarter of 2018 compared to about RMB13,400 in last quarter and about RMB12,100 in the fourth quarter of 2017. SG&A expenses as a percentage of total revenue decreased to 9.9% from 10.8% in the fourth quarter of 2017 and increased from 8% in the third quarter of 2018.

Interest expense this quarter was about $20.6 million compared to about $21.8 million last quarter and $25.2 million in same quarter last year. The year-over-year decrease was caused by a lower debt balance at the end of fourth quarter of 2018. Due to foreign exchange fluctuations, the exchange loss in this quarter was about $55,000 (ph) compared to about $13.5 million (ph) of exchange loss last quarter.Net income for the fourth quarter increased to $104.2 million compared to $35.4 million net earnings for the fourth quarter of 2017.

Diluted net earnings per ADS attributable to shareholders were $1.15 compared to $0.50 net earnings per ADS in the fourth quarter of 2017. The Company repurchased the $2.2 billion ADS in fourth quarter of 2018. The total ADS repurchased in 2018 is $4.5 million.

Our full year contract sales over 2018 decreased because it only includes contracts that qualify for revenue recognition. Excluded contracts will be qualified in the coming quarters and the contract sales will be recovered.

Balance sheet; as of December 31st, 2018, the Company's cash and the cash equivalents was $1.2 billion compared to $1.4 billion as of September 30th, 2018. Total debt outstanding was $3.5 billion, decreasing from $4.1 billion at the end of the third quarter of 2018. The balance of the Company's real estate properties under development at the end of fourth quarter of 2018 was about $3.8 billion compared to $4.5 billion at the end of the third quarter of 2018. Shareholders' equity at the end of fourth quarter of 2018 was about $758 million (ph) compared to about $658 million (ph) as of the end of third quarter of 2018.

Project updates; as of December 31st, 2018, our total unsold land bank was 12.7 million square meters (ph). US project updates; as of December 31st, 2018, our Oosten project in Brooklyn, New York, has recognized a total revenue of about $259.3 million from the sales of 176 units out of 216 total units, representing approximately 81.5% of the total units sold.

Our Hudson Garden project in Manhattan, New York, completed construction up to sixth floor. Due to design drawings optimization, the total number of units increased from 82 to 92. A total of about 29,000 square foot out of the 38,000 square foot of retail or commercial space has been leased to the US department store retailer Target with a 20-year lease. A soft launch began in the fourth quarter of 2018.

We continue to execute on planning, governmental approvals, and pre-development of our ground-up development project in Flushing, New York. After the Landmark Protection Committee's approval on our landmark protection plan, we were awarded with a Certificate of Appropriateness. Transfer of work has to be completed by the end of February 2019.

UK projects update; in the fourth quarter of 2018, we added another 8 floors to the structural core of the building with only 11 floors left to finish for a 53-story building for our completion target of 2020. By the end of the fourth quarter of 2018, all of the 104 Affordable Housing apartments of the 423-unit Madison project have been presold. Of the remaining 319 apartments, 133 apartments have been sold, representing 41.7% of the total number of units.

Dividend; we announced a cash dividend for the fourth quarter of 2018 of $0.10 per ADS which will be paid before March 12, 2019, to shareholders of record as of February 25, 2019. And finally, on to our full year 2018 financial forecast. For 2019, we expect an increase in contract sales of about 10% and an increase in consolidated net income of 15% to 20% over 2018.

This concludes my prepared remarks for today's call. Operator, we are now ready to take some questions.

Questions and Answers:

Operator

Thank you. (Operator Instructions) We will take our next question from Michael Prouting with 10K Capital.

Michael Frederick Prouting -- 10K Capital LLC -- Analyst

Yeah. Good morning. Thanks for hosting the call and taking my question. I didn't see any update in the press release on your blockchain initiatives, so I was wondering if you could just update us on that and any plans that you may have to try to have the value of that initiative reflected in stock price. Thank you.

Unidentified Speaker --

(Foreign Language) Well, as for the business of blockchain for Xinyuan, we used to release that in our previous quarterly report. And the application for blockchain technology in Xinyuan is now in the very early phase of exploration, especially for the application with our traditional real estate (ph) industry, especially for example like the EVS (ph) project now is in the very early phase. In future days we will have more comprehensive trying and exploration in this area.

Operator

(Operator Instructions) And there are no questions at this time, so I'd like to turn the call back over to management for any additional or closing remarks.

Xuefeng Li -- Interim Chief Financial Officer

Okay. We thank you for joining us on today's call, and we appreciate your ongoing support. We look forward to updating you on our progress in the weeks and month ahead. Thank you again.

Operator

And that concludes today's presentation. We thank you for your participation. You may now disconnect.

Duration: 17 minutes

Call participants:

William Zima -- Investor Relations

Lizhou Zhang -- Chief Executive Officer & Executive Director

Xuefeng Li -- Interim Chief Financial Officer

Michael Frederick Prouting -- 10K Capital LLC -- Analyst

Unidentified Speaker --

More XIN analysis

Transcript powered by AlphaStreet

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

Shares of WVS Financial Corp. (NASDAQ:WVFC) reached a new 52-week high during mid-day trading on Thursday . The stock traded as high as $18.44 and last traded at $17.06, with a volume of 9040 shares changing hands. The stock had previously closed at $16.65.

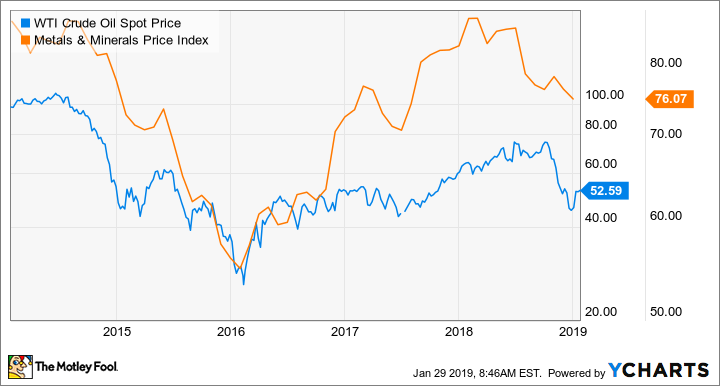

Shares of WVS Financial Corp. (NASDAQ:WVFC) reached a new 52-week high during mid-day trading on Thursday . The stock traded as high as $18.44 and last traded at $17.06, with a volume of 9040 shares changing hands. The stock had previously closed at $16.65. Several factors are fueling a rise in crude oil prices right now. And we're just getting started on an extended crude price rally that will take us through the third quarter of 2019.

Several factors are fueling a rise in crude oil prices right now. And we're just getting started on an extended crude price rally that will take us through the third quarter of 2019. …

… Royal Bank of Scotland Group (LON:RBS)‘s stock had its “buy” rating reaffirmed by equities research analysts at Jefferies Financial Group in a research note issued on Friday. They currently have a GBX 341 ($4.46) target price on the financial services provider’s stock. Jefferies Financial Group’s price objective points to a potential upside of 35.32% from the company’s current price.

Royal Bank of Scotland Group (LON:RBS)‘s stock had its “buy” rating reaffirmed by equities research analysts at Jefferies Financial Group in a research note issued on Friday. They currently have a GBX 341 ($4.46) target price on the financial services provider’s stock. Jefferies Financial Group’s price objective points to a potential upside of 35.32% from the company’s current price.

uld skyrocket as much as 400% in a year.

uld skyrocket as much as 400% in a year.