NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing. Since September of last year, the Fed has been buying $85 billion in mortgage-backed securities and Treasury bonds a month to help support the economy. The purchases have been credited for the historically low mortgage rates seen this year, which ultimately helped stimulate home sales and boost prices.

But now the Fed is expected to announce that it will scale back on its bond-buying program -- a move that is expected to cause rates to slowly rise, said Doug Duncan, chief economist for Fannie Mae.

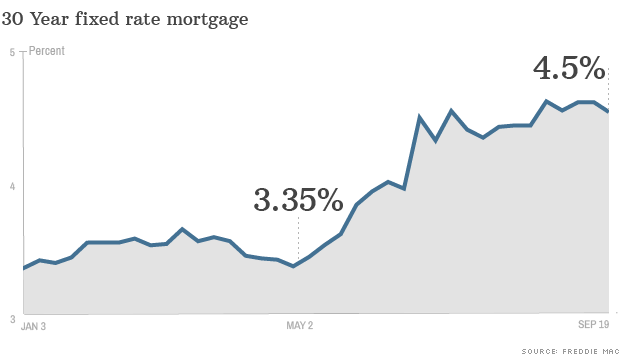

The mortgage market has already factored in a modest cutback in the Fed's purchases. Mortgage rates have risen 1.2 percentage points since May when Fed chairman Ben Bernanke mentioned the possibility of reducing the agency's bond-buying program. In June, he noted that the tapering could begin as early as September, if the economic recovery continued on course.

However, even if the Fed started cutting back on its bond purchases this month, many don't expect the cuts to be sizable. "The recovery has been weaker the past couple of months than what the Fed had been talking about," said Duncan. "It would be a surprise if they act aggressively."

Duncan said initial cuts to the bond-buying program likely won't exceed $10 billion a month and most of those cuts will be in Treasuries.

Those expectations were reinforced in a paper presented by Northwestern University economists Arvind Krishnamurthy and Annette Vissing-Jorgensen at an annual meeting for central bankers in Jackson Hole, Wyo., late last month. The economists found that the purchase of mortgage-backed securities served as a more effective stimulus than the purchase of Treasury bonds.

Should the Fed continue to purchase mortgage-backed securities at current rates, there is a chance mortgage rates could actually head lower, said Keith Gumbinger of HSH.com, a mortgage information provider.

Frank Nothaft, chief economist for Freddie Mac, expects the Fed to act slightly more aggressively. He anticipates that the agency will cut its purchases of Treasuries by about $10 billion a month and reduce its purchases of mortgage-backed securities by $5 billion. He expects the Fed to continu! e to scale back its purchases through mid-2014, when the program would end entirely.

As a result, Nothaft expects mortgage rates to climb to close to 5% by next June. Last week, the 30-year fixed rate averaged 4.6%.

Quiz: How much do you know about mortgages?

Despite higher mortgage rates, only a small number of potential homebuyers -- those who would have to struggle to afford a home in the first place -- would put the brakes on their purchases, said Nothaft.

Remaining buyers would probably welcome a slight cooling off in the housing market. Home prices were up 12.1% in June compared with a year earlier, according to the S&P/Case-Shiller home price index.

That kind of surge has stirred fears of a new housing bubble and many economists -- and homebuyers -- wouldn't mind seeing price gains come back to more normal levels. ![]()

Being more than 200 years old, the stock market has had time to foster a staggering number of axioms, tips, disciplines and lessons. Indeed, one thing there’s never a shortage of on Wall Street is advice.

Being more than 200 years old, the stock market has had time to foster a staggering number of axioms, tips, disciplines and lessons. Indeed, one thing there’s never a shortage of on Wall Street is advice. This might have been solid advice a couple of decades ago when a stock’s price was a reflection of a company’s operation, slightly adjusted higher or lower depending on the organization’s plausible outlook.

This might have been solid advice a couple of decades ago when a stock’s price was a reflection of a company’s operation, slightly adjusted higher or lower depending on the organization’s plausible outlook. The market may be tricky, inconsistent, exhausting, unduly-influenced, erratic and unpredictable, but it’s not rigged.

The market may be tricky, inconsistent, exhausting, unduly-influenced, erratic and unpredictable, but it’s not rigged. Aside from sticking with safe and stable names simply as a way to maintain your sanity, the industry often encourages a focus on value stocks by noting they actually yield better bottom results over the long haul. Problem: It’s only true sometimes. Other times, it’s completely untrue.

Aside from sticking with safe and stable names simply as a way to maintain your sanity, the industry often encourages a focus on value stocks by noting they actually yield better bottom results over the long haul. Problem: It’s only true sometimes. Other times, it’s completely untrue. Odds are that you’ll never successfully step into a stock right in front of an acquisition for any reason other than luck. Suitors make a point of keeping the lid on M&A plans specifically to avoid front-running a buyout and driving up a price. And, in the rare case where news of an impending buyout is leaked, there’s always someone with closer ties that can act on the information sooner than you can (assuming you’re not in those particular board meetings).

Odds are that you’ll never successfully step into a stock right in front of an acquisition for any reason other than luck. Suitors make a point of keeping the lid on M&A plans specifically to avoid front-running a buyout and driving up a price. And, in the rare case where news of an impending buyout is leaked, there’s always someone with closer ties that can act on the information sooner than you can (assuming you’re not in those particular board meetings). There’s actually a little bit of truth to this axiom that Jim Cramer turned into an outright cliche. There’s an important footnote missing from the idea, however.

There’s actually a little bit of truth to this axiom that Jim Cramer turned into an outright cliche. There’s an important footnote missing from the idea, however. Flower Foods is taking advantage of the demise of a competitor to boost its own market position. For investors looking for one of the "winners" in the bread and snack cake wars, Flower Foods would be it.Want More of Our Best Recommendations? Zacks' Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Then each week he hand-selects the most compelling trades and serves them up to you in a new program called Zacks Confidential. Learn More>>Tracey Ryniec is the Value Stock Strategist for Zacks.com. She is also the Editor of the Turnaround Trader and Value Investor services. You can follow her on twitter at @TraceyRyniec.

Flower Foods is taking advantage of the demise of a competitor to boost its own market position. For investors looking for one of the "winners" in the bread and snack cake wars, Flower Foods would be it.Want More of Our Best Recommendations? Zacks' Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Then each week he hand-selects the most compelling trades and serves them up to you in a new program called Zacks Confidential. Learn More>>Tracey Ryniec is the Value Stock Strategist for Zacks.com. She is also the Editor of the Turnaround Trader and Value Investor services. You can follow her on twitter at @TraceyRyniec.

Popular Posts: 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014Why Warren Buffett Suggests Vanguard FundsHalftime Report – How Does Tesla Stock Look Now? (TSLA) Recent Posts: Halftime Report – How Does Tesla Stock Look Now? (TSLA) 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014 Why Warren Buffett Suggests Vanguard Funds View All Posts Halftime Report – How Does Tesla Stock Look Now? (TSLA)

Popular Posts: 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014Why Warren Buffett Suggests Vanguard FundsHalftime Report – How Does Tesla Stock Look Now? (TSLA) Recent Posts: Halftime Report – How Does Tesla Stock Look Now? (TSLA) 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014 Why Warren Buffett Suggests Vanguard Funds View All Posts Halftime Report – How Does Tesla Stock Look Now? (TSLA)  Question: When are 60% returns in six months disappointing?

Question: When are 60% returns in six months disappointing?