By passing a bill that funds the government except for Obamacare, House Republicans have launched a battle with Democrats that could result in a federal government shutdown.

NEW YORK (CNNMoney) It would be inconvenient and frustrating. But how much would a federal government shutdown affect the economy?It depends on how long it lasts.

"The effects build over time: Two weeks is worse than one week, and three works is still worse than two weeks, and four is still worse than that," Congressional Budget Office Director Douglas Elmendorf said earlier this week.

Mark Zandi, chief economist and co-founder of Moody's Analytics, got more specific.

Zandi estimates that a shutdown that lasts just a few days might cost the economy two-tenths of a percentage point of annualized growth during the fourth quarter. That's the economic equivalent of a smidge.

But if a shutdown runs for three or four weeks? "[That] would do significant economic damage" -- reducing GDP by 1.4 percentage points for the quarter, Zandi said in congressional testimony.

The last time there was a shutdown that long was at the end of 1995, when the government was shut down twice for nearly four weeks combined.

The CBO estimated those shutdowns shaved only about half a percentage point off growth in the fourth quarter of that year.

CNN: House GOP votes to defund Obamacare

Zandi said he is assuming a greater hit this time for two reasons. The first is timing: The 1995 shutdowns started in the second half of the quarter. This time, if Congress fails to pass a funding bill, the shutdown will begin on Oct. 1, the start of a new quarter.

In addition, Zandi noted, "the economy is much more fragile today than in 1995-96 when the economy was on the verge of the tech boom."

Mohamed El-E! rian, the CEO of bond fund firm PIMCO, thinks a shutdown could have several negative effects.

"First, it increases uncertainty which makes companies less willing to invest in new plants, equipment and hiring. Second, it forces the Fed to continue with experimental policies, the impact of which are uncertain," El-Erian told CNN.

Much might depend, too, on just how much of the federal government remains running during a shutdown. The White House will have some discretion in determining what's essential and what's not.

Typically any federal program or agency charged with protecting life and property -- such as air traffic control and food inspections -- is deemed critical, so operations there are likely to continue uninterrupted. Also likely to continue would be benefit payments such as Social Security checks.

But much of the federal government would be shuttered, and the money those agencies would normally spend would be delayed. Hundreds of thousands of federal workers would be furloughed without pay.

Another factor that could affect the economy in a prolonged shutdown is consumer, investor and business psychology, Zandi said.

And there's no telling what their psychology would be if a shutdown runs concurrent with a major standoff over the debt ceiling, raising the risk of a U.S. default. ![]()

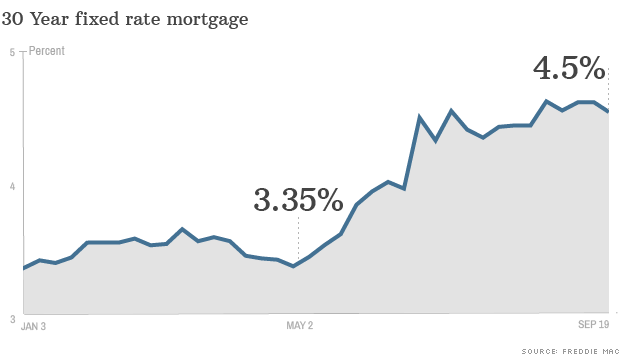

NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

NEW YORK (CNNMoney) Housing market experts are keeping a close eye on the Federal Reserve as they anxiously await word on whether the agency will start pulling back on its controversial stimulus program, known as quantitative easing.

Being more than 200 years old, the stock market has had time to foster a staggering number of axioms, tips, disciplines and lessons. Indeed, one thing there’s never a shortage of on Wall Street is advice.

Being more than 200 years old, the stock market has had time to foster a staggering number of axioms, tips, disciplines and lessons. Indeed, one thing there’s never a shortage of on Wall Street is advice. This might have been solid advice a couple of decades ago when a stock’s price was a reflection of a company’s operation, slightly adjusted higher or lower depending on the organization’s plausible outlook.

This might have been solid advice a couple of decades ago when a stock’s price was a reflection of a company’s operation, slightly adjusted higher or lower depending on the organization’s plausible outlook. The market may be tricky, inconsistent, exhausting, unduly-influenced, erratic and unpredictable, but it’s not rigged.

The market may be tricky, inconsistent, exhausting, unduly-influenced, erratic and unpredictable, but it’s not rigged. Aside from sticking with safe and stable names simply as a way to maintain your sanity, the industry often encourages a focus on value stocks by noting they actually yield better bottom results over the long haul. Problem: It’s only true sometimes. Other times, it’s completely untrue.

Aside from sticking with safe and stable names simply as a way to maintain your sanity, the industry often encourages a focus on value stocks by noting they actually yield better bottom results over the long haul. Problem: It’s only true sometimes. Other times, it’s completely untrue. Odds are that you’ll never successfully step into a stock right in front of an acquisition for any reason other than luck. Suitors make a point of keeping the lid on M&A plans specifically to avoid front-running a buyout and driving up a price. And, in the rare case where news of an impending buyout is leaked, there’s always someone with closer ties that can act on the information sooner than you can (assuming you’re not in those particular board meetings).

Odds are that you’ll never successfully step into a stock right in front of an acquisition for any reason other than luck. Suitors make a point of keeping the lid on M&A plans specifically to avoid front-running a buyout and driving up a price. And, in the rare case where news of an impending buyout is leaked, there’s always someone with closer ties that can act on the information sooner than you can (assuming you’re not in those particular board meetings). There’s actually a little bit of truth to this axiom that Jim Cramer turned into an outright cliche. There’s an important footnote missing from the idea, however.

There’s actually a little bit of truth to this axiom that Jim Cramer turned into an outright cliche. There’s an important footnote missing from the idea, however. Flower Foods is taking advantage of the demise of a competitor to boost its own market position. For investors looking for one of the "winners" in the bread and snack cake wars, Flower Foods would be it.Want More of Our Best Recommendations? Zacks' Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Then each week he hand-selects the most compelling trades and serves them up to you in a new program called Zacks Confidential. Learn More>>Tracey Ryniec is the Value Stock Strategist for Zacks.com. She is also the Editor of the Turnaround Trader and Value Investor services. You can follow her on twitter at @TraceyRyniec.

Flower Foods is taking advantage of the demise of a competitor to boost its own market position. For investors looking for one of the "winners" in the bread and snack cake wars, Flower Foods would be it.Want More of Our Best Recommendations? Zacks' Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Then each week he hand-selects the most compelling trades and serves them up to you in a new program called Zacks Confidential. Learn More>>Tracey Ryniec is the Value Stock Strategist for Zacks.com. She is also the Editor of the Turnaround Trader and Value Investor services. You can follow her on twitter at @TraceyRyniec.

Popular Posts: 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014Why Warren Buffett Suggests Vanguard FundsHalftime Report – How Does Tesla Stock Look Now? (TSLA) Recent Posts: Halftime Report – How Does Tesla Stock Look Now? (TSLA) 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014 Why Warren Buffett Suggests Vanguard Funds View All Posts Halftime Report – How Does Tesla Stock Look Now? (TSLA)

Popular Posts: 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014Why Warren Buffett Suggests Vanguard FundsHalftime Report – How Does Tesla Stock Look Now? (TSLA) Recent Posts: Halftime Report – How Does Tesla Stock Look Now? (TSLA) 35 Blue-Chip Dividend Stocks Increasing Payouts in Q2 2014 Why Warren Buffett Suggests Vanguard Funds View All Posts Halftime Report – How Does Tesla Stock Look Now? (TSLA)  Question: When are 60% returns in six months disappointing?

Question: When are 60% returns in six months disappointing?

Popular Posts: The Top 10 S&P 500 Dividend Stocks for May5 Stocks to Sell at All-Time HighsTwitter Stock Gets Third Upgrade in Three Days … And Still Isn’t a Good Buy Recent Posts: Marijuana Stocks Could be Scams, Warns SEC Watchdogs Earnings Watch: 5 Crummy Retail Stocks on Deck Warren Buffett Buys a Stake in Verizon, Sells a Chunk of GM View All Posts

Popular Posts: The Top 10 S&P 500 Dividend Stocks for May5 Stocks to Sell at All-Time HighsTwitter Stock Gets Third Upgrade in Three Days … And Still Isn’t a Good Buy Recent Posts: Marijuana Stocks Could be Scams, Warns SEC Watchdogs Earnings Watch: 5 Crummy Retail Stocks on Deck Warren Buffett Buys a Stake in Verizon, Sells a Chunk of GM View All Posts  Marijuana stocks are bad news, we’ve pointed out again and again. Of course, that doesn’t mean we’re bearish on the legalized pot industry… but the pitfalls of marijuana stocks for individual investors are far different than the business of growing, selling or even buying pot where it is legal.

Marijuana stocks are bad news, we’ve pointed out again and again. Of course, that doesn’t mean we’re bearish on the legalized pot industry… but the pitfalls of marijuana stocks for individual investors are far different than the business of growing, selling or even buying pot where it is legal. View from Mission Bay, Auckland, New Zealand (Photo credit: Jaafar Alnasser Photography)

View from Mission Bay, Auckland, New Zealand (Photo credit: Jaafar Alnasser Photography)

) fell over 5% on Friday morning after the company missed estimates and lowered its outlook for 2014.

) fell over 5% on Friday morning after the company missed estimates and lowered its outlook for 2014. AFP/Getty Images

AFP/Getty Images  • 10 money-making investment ideas for 2014

• 10 money-making investment ideas for 2014  Laurence D. Fink Bloomberg News

Laurence D. Fink Bloomberg News  ABX data by YCharts Barrick's earnings and sales growth depends on the price of gold staying afloat. In a recent interview CEO Jamie Sokalsky proclaimed, "This company has a more disciplined capital-allocation framework and is focused on cost control, portfolio optimization return on investment and free cash flow."

ABX data by YCharts Barrick's earnings and sales growth depends on the price of gold staying afloat. In a recent interview CEO Jamie Sokalsky proclaimed, "This company has a more disciplined capital-allocation framework and is focused on cost control, portfolio optimization return on investment and free cash flow." NEM data by YCharts

NEM data by YCharts  REUTERS

REUTERS  [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlar! ge Image ! ]

[ Enlar! ge Image ! ] [ Enlarge Image ]

[ Enlarge Image ] [ Enlarge Image ]

[ Enlarge Image ]  [ Enlarge Image ]

[ Enlarge Image ]