Jeff Bezos is a fascinating man in so many different ways. In the past 15 years or so, Bezos set up the ultimate store. It sells both physical and digital goods all around the world.

Amazon is able to get incredibly valuable data on what is being sold, by who and where it's shipped and then can adapt by getting more involved when it makes sense.

Now that Amazon is dominant in so many categories and now launching media consumption products such as tablets, phones, and tv consoles and expanding its app store to other platforms such as Blackberry. The goal of course remains to get dominant market share which it has achieved in several product categories. Then, it's able to negotiate with suppliers in a position of power and bully them if needed (see Hachette's very public battle with Amazon for a good example).

Among other things, Amazon now produces or sells:

Among other things, Amazon now produces or sells:

-Digital content (storage, music, ebooks, audiobooks, video (some of it leased from HBO and other studios and other produced itself) -Its own media devices (tablets, ebook readers, tv consoles, smartphones, etc)

-Physical stuff: -dvd's, cd's, etc -electronics and computers -home, gardent and tools -beauty, health and grocery -toys, kids and baby items -clothing, shoes and jewelry -sports and outdoor stuff -automative stuff

Amazon also owns several brands such as Zappos which have very strong brands.

So yes, Amazon is taking over the world. It is taking its lead in some areas and taking that edge to extend it into new products. I just don't see anyone able to successfully compete with the Bezos empire, no matter if they're called Google or Walmart. It's too late for that. Yes, at some point Amazon will need to produce some profits but in the meantime it's been able to spend a decade of profits into building the top distribution and technoloy in order to manage such a franchise where having a "local" presence takes a whole new meaning.

Will I buy Amazon? Probably at some point, I'm just looking for the right entry point as I continue to believe the downside vs upside risk remains poor.| Currently 0.00/512345 Rating: 0.0/5 (0 votes) |

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

334.38 (1y: +22%) $(function(){var seriesOptions=[],yAxisOptions=[],name='AMZN',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1371704400000,273.44],[1371790800000,273.36],[1372050000000,270.61],[1372136400000,272.088],[1372222800000,277.57],[1372309200000,277.55],[1372395600000,277.69],[1372654800000,282.1],[1372741200000,283.73],[1372827600000,284.03],[1373000400000,285.88],[1373259600000,290.59],[1373346000000,291.53],[1373432400000,292.33],[1373518800000,299.66],[1373605200000,307.55],[1373864400000,306.57],[1373950800000,306.87],[1374037200000,308.69],[1374123600000,304.11],[1374210000000,305.23],[1374469200000,303.48],[1374555600000,301.06],[1374642000000,298.94],[1374728400000,303.4],[1374814800000,312.01],[1375074000000,306.1],[1375160400000,302.41],[1375246800000,301.22],[1375333200000,305.57],[1375419600000,304.21],[1375678800000,300.99],[1375765200000,300.75],[1375851600000,296.91],[1375938000000,295.74],[1376024400000,297.26],[1376283600000,296.69],[1376370000000,293.97],[1376456400000,291.34],[1376542800000,286.47],[1376629200000,284.82],[1376888400000,285.57],[1376974800000,287.09],[1377061200000,284.57],[1377147600000,289.73],[1377234000000,290.01],[1377493200000,286.21],[1377579600000,280.93],[1377666000000,281.58],[1377752400000,283.98],[1377838800000,280.98],[1378184400000,288.8],[1378270800000,293.64],[1378357200000,294.1],[1378443600000,295.86],[1378702800000,299.71],[1378789200000,300.36],[1378875600000,299.64],[1378962000000,298.86],[1379048400000,297.92],[1379307600000,296.06],[1379394000000,304.17],[1379480400000,312.034],[1379566800000,312.06],[1379653200000,316.34],[1379912400000,311.49],[1379998800000,314.13],[1380085200000,312.65],[1380171600000,318.12],[1380258000000,316.01],[1380517200000,312.64],[1380603600000,320.95],[1380690000000,320.51],[1380776400000,314.76],[1380862800000,319.04],[1381122000000,310.03],[1381208400000,303.23],[1381294800000,298.23],[1381381200000,305.174],[1381467600000,310.889],[1381726800000,310.7],[1381813200000,306.4],[1381899600000,310.49],[13! 81986000000,310.77],[1382072400000,328.931],[1382331600000,326.44],[1382418000000,332.54],[1382504400000,326.756],[1382590800000,332.21],[1382677200000,363.39],[1382936400000,358.16],[1383022800000,362.7],[1383109200000,361.08],[1383195600000,364.03],[1383282000000,359.002],[1383544800000,358.74],[1383631200000,358.892],[1383717600000,356.18],[1383804000000,343.56],[1383890400000,350.31],[1384149600000,354.378],[1384236000000,349.53],[1384322400000,356.22],[1384408800000,367.396],[1384495200000,369.17],[1384754400000,366.18],[1384840800000,364.94],[1384927200000,362.57],[1385013600000,368.92],[1385100000000,372.31],[1385359200000,376.64],[1385445600000,381.37],[1385532000000,386.71],[1385704800000,393.62],[1385964000000,392.3],[1386050400000,384.66],[1386136800000,385.96],[1386223200000,384.49],[1386309600000,386.95],[1386568800000,384.89],[1386655200000,387.78],[1386741600000,382.19],[1386828000000,381.25],[1386914400000,384.24],[1387173600000,388.97],[1387260000000,387.65],[1387346400000,395.96],[1387432800000,395.19],[1387519200000,402.2],[1387778400000,402.92],[1387864800000,399.2],[1388037600000,404.39],[1388124000000,398.08],[1388383200000,393.37],[1388469600000,398.79],[1388642400000,397.97],[1388728800000,396.44],[1388988000000,393.63],[1389074400000,398.03],[1389160800000,401.92],[1389247200000,401.01],[1389333600000,397.66],[1389592800000,390.98],[1389679200000,397.54],[1389765600000,395.87],[1389852000000,395.8],[1389938400000,399.61],[1390284000000,407.05],[1390370400000,404.54],[1390456800000,399.87],[1390543200000,387.6],[1390802400000,386.28],[1390888800000,394.43],[1390975200000,384.2],[1391061600000,403.01],[1391148000000,358.69],[1391407200000,346.15],[1391493600000,347.95],[1391580000000,346.45],[1391666400000,354.59],[1391752800000,361.08],[1392012000000,360.87],[1392098400000,361.79],[1392184800000,349.25],[1392271200000,357.2],[1392357600000,357.35],[1392703200000,353.65],[1392789600000,347.38],[1392876000000,349.8],[1392962400000,346.76],[1393221600000,351.78],[1393308000000,358.3! 2],[13933! 94400000,359.8],[1393480800000,360.13],[1393567200000,362.1],[1393826400000,359.78],[1393912800000,363.9],[1393999200000,372.37],[1394085600000,372.16],[1394172000000,372.06],[1394427600000,370.53],[1394514000000,368.82],[1394600400000,370.64],[139468680

334.38 (1y: +22%) $(function(){var seriesOptions=[],yAxisOptions=[],name='AMZN',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1371704400000,273.44],[1371790800000,273.36],[1372050000000,270.61],[1372136400000,272.088],[1372222800000,277.57],[1372309200000,277.55],[1372395600000,277.69],[1372654800000,282.1],[1372741200000,283.73],[1372827600000,284.03],[1373000400000,285.88],[1373259600000,290.59],[1373346000000,291.53],[1373432400000,292.33],[1373518800000,299.66],[1373605200000,307.55],[1373864400000,306.57],[1373950800000,306.87],[1374037200000,308.69],[1374123600000,304.11],[1374210000000,305.23],[1374469200000,303.48],[1374555600000,301.06],[1374642000000,298.94],[1374728400000,303.4],[1374814800000,312.01],[1375074000000,306.1],[1375160400000,302.41],[1375246800000,301.22],[1375333200000,305.57],[1375419600000,304.21],[1375678800000,300.99],[1375765200000,300.75],[1375851600000,296.91],[1375938000000,295.74],[1376024400000,297.26],[1376283600000,296.69],[1376370000000,293.97],[1376456400000,291.34],[1376542800000,286.47],[1376629200000,284.82],[1376888400000,285.57],[1376974800000,287.09],[1377061200000,284.57],[1377147600000,289.73],[1377234000000,290.01],[1377493200000,286.21],[1377579600000,280.93],[1377666000000,281.58],[1377752400000,283.98],[1377838800000,280.98],[1378184400000,288.8],[1378270800000,293.64],[1378357200000,294.1],[1378443600000,295.86],[1378702800000,299.71],[1378789200000,300.36],[1378875600000,299.64],[1378962000000,298.86],[1379048400000,297.92],[1379307600000,296.06],[1379394000000,304.17],[1379480400000,312.034],[1379566800000,312.06],[1379653200000,316.34],[1379912400000,311.49],[1379998800000,314.13],[1380085200000,312.65],[1380171600000,318.12],[1380258000000,316.01],[1380517200000,312.64],[1380603600000,320.95],[1380690000000,320.51],[1380776400000,314.76],[1380862800000,319.04],[1381122000000,310.03],[1381208400000,303.23],[1381294800000,298.23],[1381381200000,305.174],[1381467600000,310.889],[1381726800000,310.7],[1381813200000,306.4],[1381899600000,310.49],[13! 81986000000,310.77],[1382072400000,328.931],[1382331600000,326.44],[1382418000000,332.54],[1382504400000,326.756],[1382590800000,332.21],[1382677200000,363.39],[1382936400000,358.16],[1383022800000,362.7],[1383109200000,361.08],[1383195600000,364.03],[1383282000000,359.002],[1383544800000,358.74],[1383631200000,358.892],[1383717600000,356.18],[1383804000000,343.56],[1383890400000,350.31],[1384149600000,354.378],[1384236000000,349.53],[1384322400000,356.22],[1384408800000,367.396],[1384495200000,369.17],[1384754400000,366.18],[1384840800000,364.94],[1384927200000,362.57],[1385013600000,368.92],[1385100000000,372.31],[1385359200000,376.64],[1385445600000,381.37],[1385532000000,386.71],[1385704800000,393.62],[1385964000000,392.3],[1386050400000,384.66],[1386136800000,385.96],[1386223200000,384.49],[1386309600000,386.95],[1386568800000,384.89],[1386655200000,387.78],[1386741600000,382.19],[1386828000000,381.25],[1386914400000,384.24],[1387173600000,388.97],[1387260000000,387.65],[1387346400000,395.96],[1387432800000,395.19],[1387519200000,402.2],[1387778400000,402.92],[1387864800000,399.2],[1388037600000,404.39],[1388124000000,398.08],[1388383200000,393.37],[1388469600000,398.79],[1388642400000,397.97],[1388728800000,396.44],[1388988000000,393.63],[1389074400000,398.03],[1389160800000,401.92],[1389247200000,401.01],[1389333600000,397.66],[1389592800000,390.98],[1389679200000,397.54],[1389765600000,395.87],[1389852000000,395.8],[1389938400000,399.61],[1390284000000,407.05],[1390370400000,404.54],[1390456800000,399.87],[1390543200000,387.6],[1390802400000,386.28],[1390888800000,394.43],[1390975200000,384.2],[1391061600000,403.01],[1391148000000,358.69],[1391407200000,346.15],[1391493600000,347.95],[1391580000000,346.45],[1391666400000,354.59],[1391752800000,361.08],[1392012000000,360.87],[1392098400000,361.79],[1392184800000,349.25],[1392271200000,357.2],[1392357600000,357.35],[1392703200000,353.65],[1392789600000,347.38],[1392876000000,349.8],[1392962400000,346.76],[1393221600000,351.78],[1393308000000,358.3! 2],[13933! 94400000,359.8],[1393480800000,360.13],[1393567200000,362.1],[1393826400000,359.78],[1393912800000,363.9],[1393999200000,372.37],[1394085600000,372.16],[1394172000000,372.06],[1394427600000,370.53],[1394514000000,368.82],[1394600400000,370.64],[139468680

Getty Images We've all heard about helicopter parents -- and some of us admit we them -- but a new survey by Coldwell Banker Real Estate indicates that children of younger parents have an outsized influence when it comes to piloting the family's financial decisions. The "Parenting and Homebuying Study of American Parents" surveyed 2,800 parents of multiple generations about spending decisions made when their children were 18 or under. It showed that 79 percent of millennial parents (age 18-34) and 70 percent of Gen X parents (age 35-59) said that most of their major purchasing decisions revolved around their kids. Only a little over half (52 percent) of boomer parents (age 50-69) and just 41 percent of parents age 70 and older said they made major purchasing decisions that revolved around their kids. Robi Ludwig, a psychotherapist and lifestyle consultant for Coldwell Banker Real Estate, says there has been a shift in the past 30 years in attitudes about major lifestyle and financial decisions, such as moving. "It used to be that when parents wanted or needed to move, they would do it, and the kids would adjust. But Gen X and millennial parents are more focused on their kids and how any change will impact them. Some of them drag their feet even if they know their house is too small or their commute is too long because they're putting the needs of their kids before the needs of the parents." Generational Shift in Attitude Toward Family When it comes to moving, the survey showed that 67 percent of millennial parents and 64 percent of Gen X parents cared most about the immediate impact on their kids' emotional well-being, while just 54 percent of boomer parents and 42 percent of parents age 70 and older said that was of primary importance in their decision to move or not. Younger parents are more likely to want to live near their own parents or their in-laws than their own parents' and grandparents' generations were. Just 29 percent of parents age 70 and older said that when they were raising children they wanted to live near their parents or spouse's parents, and 43 percent of boomer parents said this was a priority. Ludwig says that when immigrant families first come to the U.S., they often live in multigenerational households or with other relatives in nearby homes. "Over time, people got tired of living someplace where everyone knows each other's business, and they started to want to establish their independence and set boundaries for their relationships with their relatives," she says. "People started moving farther away from family members, but now we're seeing a shift back to a more middle ground with families wanting to live near each other." "Millennials actually like their parents and think of them as friends," Ludwig says. "Gen X and millennial parents also like the idea of their kids having a relationship with their grandparents and want to know they're around so they can rely on them." These attitudes are reflected in the survey results, with 62 percent of millennial parents and 57 percent of gen X parents saying they want their mothers, fathers or in-laws nearby. Balancing What's Best for the Kids and Best for You

Getty Images We've all heard about helicopter parents -- and some of us admit we them -- but a new survey by Coldwell Banker Real Estate indicates that children of younger parents have an outsized influence when it comes to piloting the family's financial decisions. The "Parenting and Homebuying Study of American Parents" surveyed 2,800 parents of multiple generations about spending decisions made when their children were 18 or under. It showed that 79 percent of millennial parents (age 18-34) and 70 percent of Gen X parents (age 35-59) said that most of their major purchasing decisions revolved around their kids. Only a little over half (52 percent) of boomer parents (age 50-69) and just 41 percent of parents age 70 and older said they made major purchasing decisions that revolved around their kids. Robi Ludwig, a psychotherapist and lifestyle consultant for Coldwell Banker Real Estate, says there has been a shift in the past 30 years in attitudes about major lifestyle and financial decisions, such as moving. "It used to be that when parents wanted or needed to move, they would do it, and the kids would adjust. But Gen X and millennial parents are more focused on their kids and how any change will impact them. Some of them drag their feet even if they know their house is too small or their commute is too long because they're putting the needs of their kids before the needs of the parents." Generational Shift in Attitude Toward Family When it comes to moving, the survey showed that 67 percent of millennial parents and 64 percent of Gen X parents cared most about the immediate impact on their kids' emotional well-being, while just 54 percent of boomer parents and 42 percent of parents age 70 and older said that was of primary importance in their decision to move or not. Younger parents are more likely to want to live near their own parents or their in-laws than their own parents' and grandparents' generations were. Just 29 percent of parents age 70 and older said that when they were raising children they wanted to live near their parents or spouse's parents, and 43 percent of boomer parents said this was a priority. Ludwig says that when immigrant families first come to the U.S., they often live in multigenerational households or with other relatives in nearby homes. "Over time, people got tired of living someplace where everyone knows each other's business, and they started to want to establish their independence and set boundaries for their relationships with their relatives," she says. "People started moving farther away from family members, but now we're seeing a shift back to a more middle ground with families wanting to live near each other." "Millennials actually like their parents and think of them as friends," Ludwig says. "Gen X and millennial parents also like the idea of their kids having a relationship with their grandparents and want to know they're around so they can rely on them." These attitudes are reflected in the survey results, with 62 percent of millennial parents and 57 percent of gen X parents saying they want their mothers, fathers or in-laws nearby. Balancing What's Best for the Kids and Best for You

) had its price target raised to $35 from $34 at FBR Capital. The ratings company also affirmed that Gannett is a “Top Pick.”

) had its price target raised to $35 from $34 at FBR Capital. The ratings company also affirmed that Gannett is a “Top Pick.”

Being more than 200 years old, the stock market has had time to foster a staggering number of axioms, tips, disciplines and lessons. Indeed, one thing there’s never a shortage of on Wall Street is advice.

Being more than 200 years old, the stock market has had time to foster a staggering number of axioms, tips, disciplines and lessons. Indeed, one thing there’s never a shortage of on Wall Street is advice. This might have been solid advice a couple of decades ago when a stock’s price was a reflection of a company’s operation, slightly adjusted higher or lower depending on the organization’s plausible outlook.

This might have been solid advice a couple of decades ago when a stock’s price was a reflection of a company’s operation, slightly adjusted higher or lower depending on the organization’s plausible outlook. The market may be tricky, inconsistent, exhausting, unduly-influenced, erratic and unpredictable, but it’s not rigged.

The market may be tricky, inconsistent, exhausting, unduly-influenced, erratic and unpredictable, but it’s not rigged. Aside from sticking with safe and stable names simply as a way to maintain your sanity, the industry often encourages a focus on value stocks by noting they actually yield better bottom results over the long haul. Problem: It’s only true sometimes. Other times, it’s completely untrue.

Aside from sticking with safe and stable names simply as a way to maintain your sanity, the industry often encourages a focus on value stocks by noting they actually yield better bottom results over the long haul. Problem: It’s only true sometimes. Other times, it’s completely untrue. Odds are that you’ll never successfully step into a stock right in front of an acquisition for any reason other than luck. Suitors make a point of keeping the lid on M&A plans specifically to avoid front-running a buyout and driving up a price. And, in the rare case where news of an impending buyout is leaked, there’s always someone with closer ties that can act on the information sooner than you can (assuming you’re not in those particular board meetings).

Odds are that you’ll never successfully step into a stock right in front of an acquisition for any reason other than luck. Suitors make a point of keeping the lid on M&A plans specifically to avoid front-running a buyout and driving up a price. And, in the rare case where news of an impending buyout is leaked, there’s always someone with closer ties that can act on the information sooner than you can (assuming you’re not in those particular board meetings). There’s actually a little bit of truth to this axiom that Jim Cramer turned into an outright cliche. There’s an important footnote missing from the idea, however.

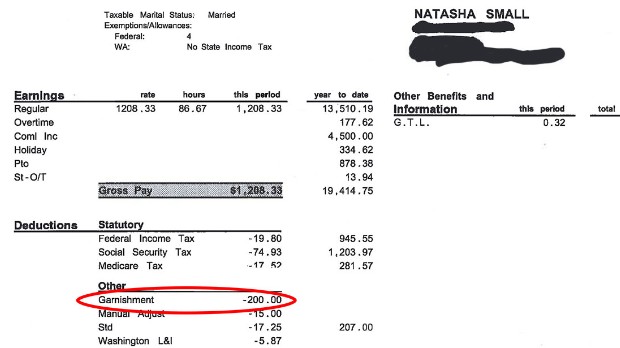

There’s actually a little bit of truth to this axiom that Jim Cramer turned into an outright cliche. There’s an important footnote missing from the idea, however. Natasha Small, right, shown with her daughter, makes $29,000 a year and is now getting her paycheck slashed by $400 a month. NEW YORK (CNNMoney) When you're only earning $29,000 a year, getting your paycheck slashed by $400 a month can be financially devastating.

Natasha Small, right, shown with her daughter, makes $29,000 a year and is now getting her paycheck slashed by $400 a month. NEW YORK (CNNMoney) When you're only earning $29,000 a year, getting your paycheck slashed by $400 a month can be financially devastating.  Small's bi-weekly paycheck.

Small's bi-weekly paycheck.  Sen. Warren cites CNNMoney story in hearing

Sen. Warren cites CNNMoney story in hearing